Opening banking and EMI (Electronic Money Institution) accounts for international operations is a crucial step for businesses aiming to expand their financial reach across borders. It involves navigating regulatory frameworks, understanding compliance requirements, and selecting appropriate financial partners that cater to global transactions efficiently. This process ensures smooth management of funds, facilitates cross-border payments, and supports the overall growth strategy of international enterprises.

The first step in Banking & EMI Accounts for international operations is identifying the right bank that offers comprehensive services tailored to multinational businesses. Many global banks provide specialized accounts designed to handle multiple currencies, enabling companies to receive payments from different countries without excessive conversion fees. When selecting a bank, it’s essential to consider factors such as transaction costs, currency exchange rates, online banking capabilities, and customer support availability in various time zones.

Once a suitable bank is chosen, businesses must prepare documentation required for account opening. This typically includes proof of company registration in the home country or host country where operations are established, identification documents of directors and beneficial owners, business plans outlining the nature of international activities, tax identification numbers, and anti-money laundering (AML) declarations. Banks conduct thorough due diligence during this stage to comply with Know Your Customer (KYC) regulations aimed at preventing fraud and illicit activities.

In parallel with traditional banking accounts, many companies choose to open an EMI account when operating internationally. EMIs are regulated entities authorized to issue electronic money and provide payment services without holding full banking licenses. They offer flexibility by enabling faster onboarding processes compared to conventional banks while maintaining compliance with stringent regulatory standards set by authorities like the Financial Conduct Authority (FCA) in the UK or similar bodies worldwide.

To open an EMI account abroad or domestically for international use requires submitting detailed business information including ownership structure details along with AML policies implemented within the organization. EMIs often specialize in offering multi-currency wallets which simplify handling foreign exchange risks associated with frequent cross-border transactions.

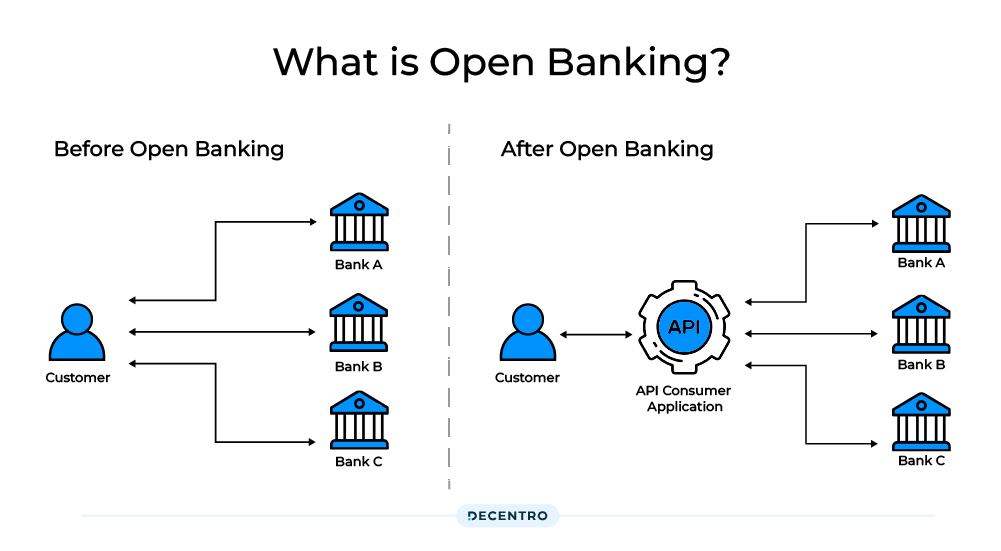

Successful integration between traditional bank accounts and EMI platforms can optimize cash flow management by leveraging each system’s strengths: banks provide stability and trustworthiness backed by deposit protection schemes whereas EMIs deliver agility through innovative payment solutions such as real-time transfers via APIs. In conclusion, opening banking and EMI accounts for international operations demands careful planning around regulatory adherence and operational needs. By choosing reliable financial providers equipped with robust compliance frameworks alongside flexible technological infrastructures allows businesses not only secure handling of funds but also scalability amidst evolving global market dynamics. Properly managed financial channels form the backbone supporting seamless expansion into new territories while enhancing transactional efficiency worldwide.